Managed Account Basics

What do participants (or employees) really want from their retirement plans? The same thing they want with everything in life – customization and personalization. From Pelotons to Starbucks, many people want things quick and customized and why should retirement savings be any different? One way to achieve a more personalized experience is through managed accounts.

Here’s What You Really Need to Know:

- A managed account is a discretionary investment management service (i.e., someone else is doing it for you without you helping them make decisions) for an individual participant’s retirement account that is typically based on the investment options available in the retirement plan.

- The qualified defaulted investment alternative (QDIA) regulations from 2008 made managed accounts one of the options that can get QDIA protection; this is alongside target date funds and balanced funds as two other options.

- Managed accounts can be created (or “driven”) by the recordkeeper or by the advisor. Advisor managed accounts (or AMAs) are when an investment advisor selects the funds in the managed account as opposed to the recordkeeper-driven managed accounts where the recordkeeper selects the funds that could include funds proprietary to that recordkeeper.

Let’s Dive In…

Defaulting a participant is typically the best way to get something accomplished with a retirement plan. This can be accomplished by selecting a rate at which a participant will automatically start saving in the retirement plan (and potentially automatically escalated up to a certain savings rate). Then, there must be an investment for those participants that don’t otherwise make an election.

By way of background, in 2006, the Pension Protection Act (arguably the biggest piece of retirement legislation until the SECURE Act in 2019) directed the Department of Labor (DOL) to issue a regulation to help plan sponsors with defaulting participants into plans. In a detailed regulation that includes notice and timing requirements, the DOL gave three options for defaulting participants that could receive safe harbor protection if all of the requirements were met: (1) managed accounts, (2) target date funds and (3) balanced funds (oh, and the regulations also allowed for a fourth option for a limited duration which is beyond the scope of this discussion).

As many of us know, target date funds really took the lead. According to recent research from PSCA, 85% of plans use a QDIA. In 2020, the default option for 86% of those plans was a target date fund, while only 4% of plans used a managed account. However, there are arguments to suggest that the numbers are shifting – and if not for the default option, then at least as an additional option in the plan.

Defaulting and Beyond

Defaulting a participant in a managed account is not the only option. Plan sponsors may either default a participant into a managed account or they may add a managed account as an additional option in the plan. Many plan sponsors select the latter option and add managed accounts as an ala carte option. When managed accounts fi rst came onto the retirement plan scene, they were primarily from recordkeepers as an ala carte option. If the plan sponsor added the managed account option, only those participants who elected to use the option were charged for this additional service. In many cases, retirement plan advisors and consultants helped plan sponsors to review the effectiveness of the managed account offering. As we will discuss below, it is important to recall that managed accounts are investment options on the plan and require a prudent review process.

More recently, advisor-managed accounts have evolved. Here, plan advisors and consultants are serving in a fi duciary capacity to the managed account. This allows the advisor or consultant to provide advice to participants (and not just the plan) while utilizing the technology of the recordkeeper to deliver the solution. Both AMA and recordkeeper-led managed accounts can be made available to a plan as either a default option or an ala carte option, but what has historically been more ala carte seems to be shifting.

A Plan Sponsor’s Obligation

Because managed accounts are part of the plan’s investments, plan sponsors are required to follow a prudent process for selection, review and replacement of a managed account service – even when there is only one managed account option available to the plan

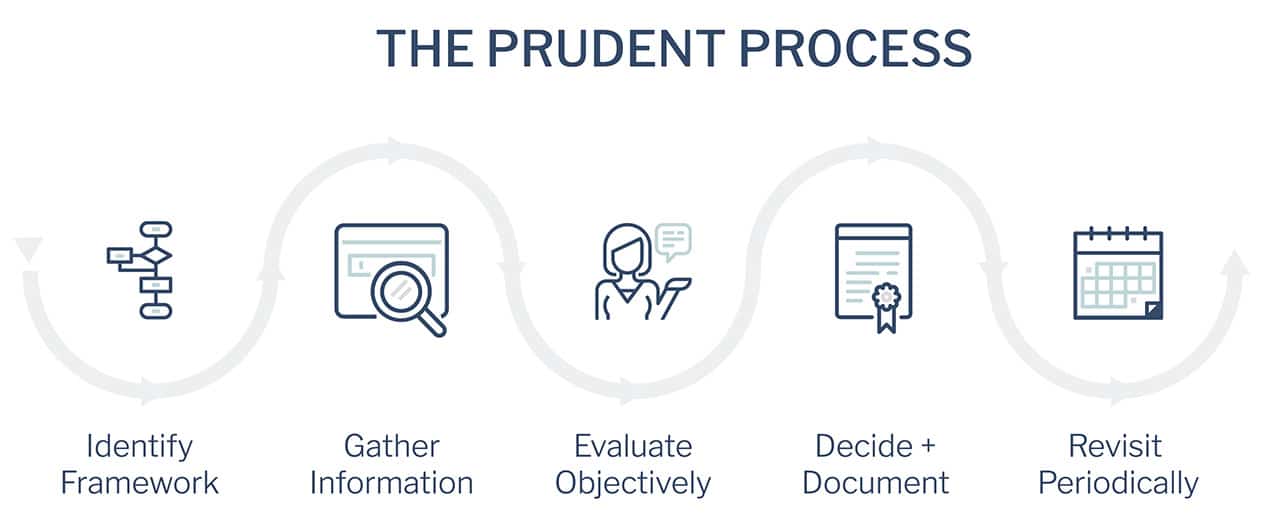

A prudent process is a framework or series of steps that can be applied to every task required by ERISA. Just like other investment options, managed accounts should have an identified framework for selection, which may be in the investment policy statement (IPS) or other stated investment guidelines or objectives. For both selection and ongoing monitoring, plan fiduciaries should gather information about the managed account (as well as other managed accounts in the marketplace) to determine how the offering fi ts within the IPS or other criteria. Once information is gathered, plan fi duciaries must objectively evaluate the information to determine if the managed account is appropriate for the plan based on the needs of the plan, its participants and the framework put in place. All decisions to select, retain and/or replace managed accounts should be welldocumented and revisited at consistent intervals. Even when there is only one option available to the plan, fi duciaries are still required to prudently select, monitor and replace (or remove entirely).

Action Items for Plan Sponsors

More frequently, plan sponsors may be presented with questions about personalization options for the plan and its participants, including managed accounts.

Before adding managed accounts, plan sponsors should be aware of their fiduciary obligations and consider the following— regardless of whether the service is added as a default or an additional ala carte investment option:

- Identify the parties providing services and particularly who is a fiduciary in each case (e.g., AMA or recordkeeper managed account).

- Understand the compensation paid for associated services.

- Determine a framework for monitoring, including what reports the advisor or recordkeeper can provide to demonstrate the value of the service and/or appropriate benchmarking.

Download This Article:

Sign Up for Navigator Today

Access More Great Content

Support your clients more efficiently with strategically curated content, that combines the expertise of ERISA Attorneys with the practicality of an Advisor.